do nonprofits pay taxes in canada

For individuals and businesses. Apply online for a payment plan including installment agreement to pay off your balance over time.

How Much Income You Need To Afford The Average Home In Every State The Housing Market Has Not Only Infographs Housing Investi Map Usa Map 30 Year Mortgage

Under which corporations or unincorporated nonprofits are exempt from these taxes.

. All of the money earned by or donated to a not-for-profit organization is used in pursuing the. The easiest countries in which to pay taxes are located in the Middle East with the UAE ranking first followed by. Not for profit describes a type of organization that does not earn profits for its owners.

You typically wont pay taxes on gifts received through international money transfers but youll need to report it using Form 3520. You must to pay taxes on gifts you send if youve given more than 1158 million in your lifetime. You might have to pay taxes on transfers you receive if they were income including capital gains.

If you pay the entire cost of a health or accident insurance plan dont include any amounts you receive for your disability as income on your tax return. Section 501c3 the famous one describes nonprofit 1 serving charitable religious scientific or educational purposes 2 no part of the income of which inures to the benefit of anyone. Social Security benefits are paid out monthly to retired workers and their spouses who have during their working years paid into the Social Security system.

Social Security benefits are also. The provinces of British Columbia Saskatchewan Manitoba and Prince Edward Island also have a provincial sales tax PST. Avoid a penalty by filing and paying your tax by the due date even if you cant pay what you owe.

If you pay the premiums of a health or accident insurance plan through a cafeteria plan and you didnt include the amount of the premium as taxable income to you the premiums are considered. Tax-exempt nonprofit organizations can and do. In Canada the federal sales tax is called the Goods and Services Tax GST and now stands at 5.

Stern Cohen Accounting And Audit Services For Nonprofits

Tax Deductible Payouts Sheet Reading Log Printable Organizing Paperwork Reading Log

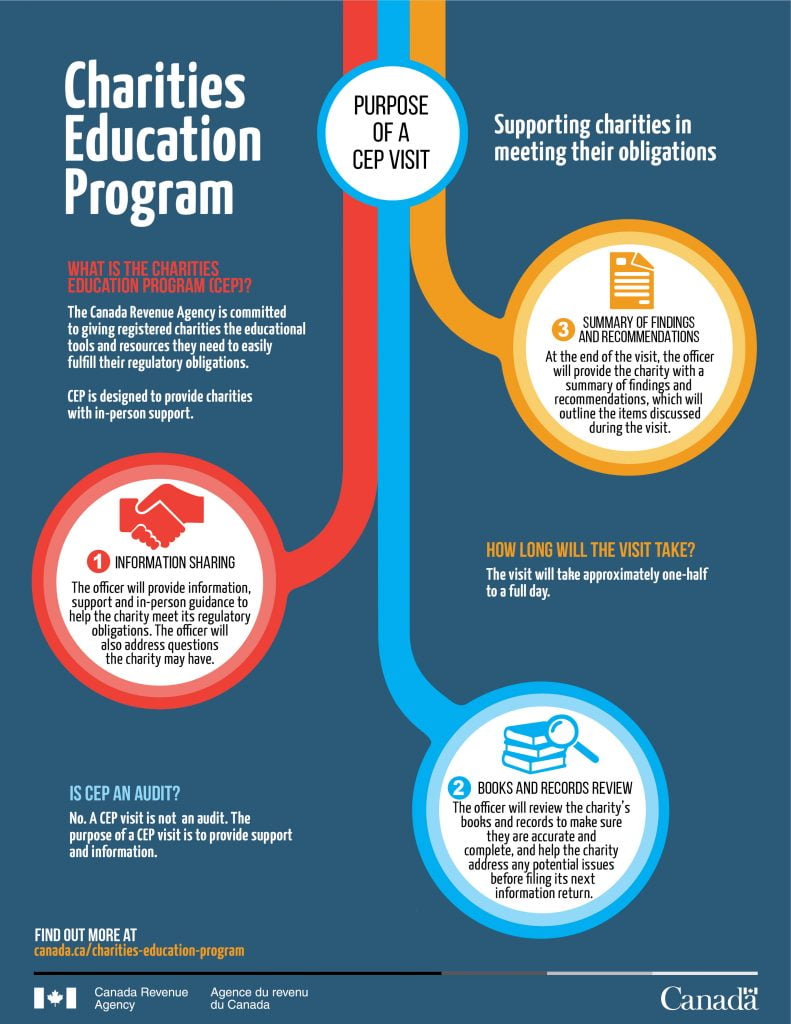

How To Make The Most Of Your Charitable Donations In Canada

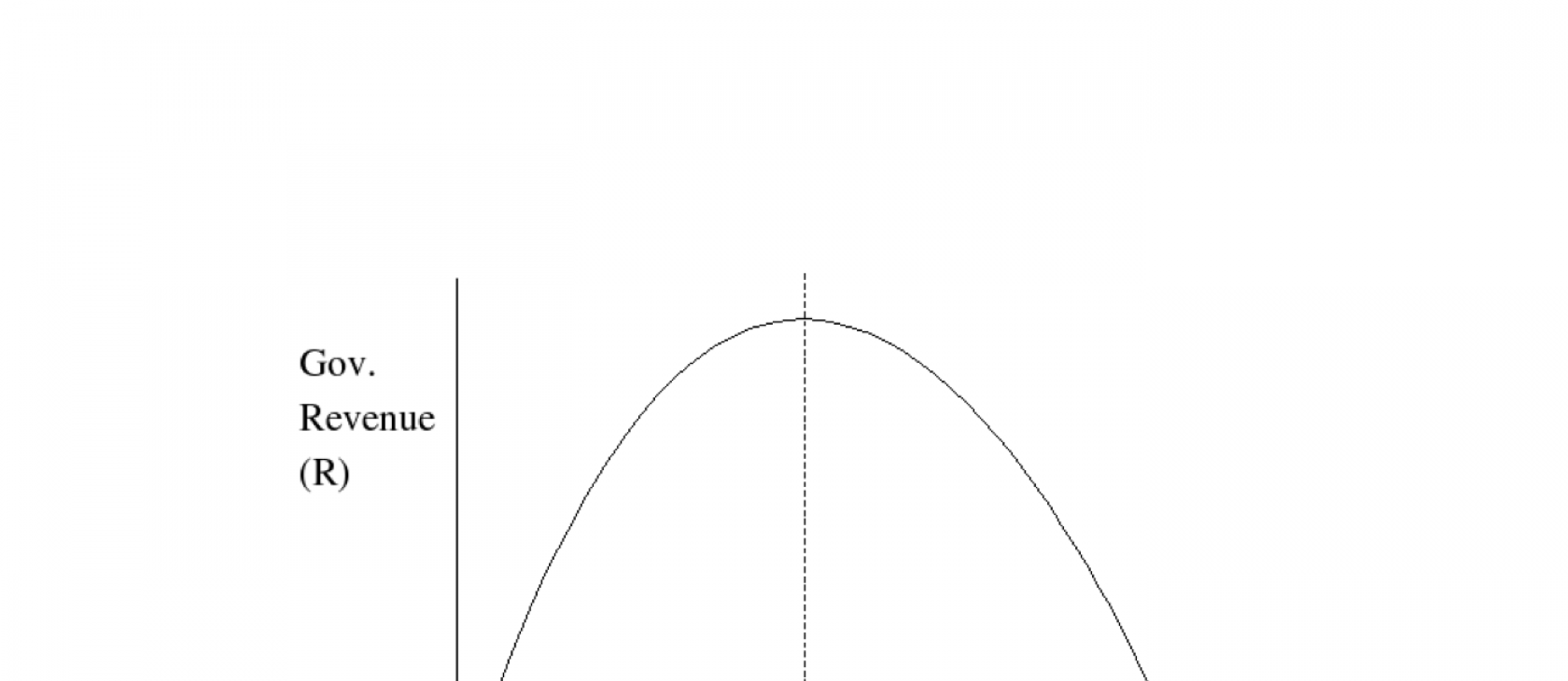

The Laffer Curve Vindicated In Canada Acton Institute

Tuition And Fees Over Time Trends In Higher Education The College Board Tuition Native American Spirituality College Board

Gift Acceptance Policy Fighting Blindness Canada Fbc

Canadian Insurance Accountants Association Industry Insights

Infographic On Charitable Giving In Canada From Imagine Canada Http Www Imaginecanada Ca Node 802 Infographic N Charitable Giving Infographic Charitable

Can You Claim Gofundme On Taxes Canada Ictsd Org

Chris Bell Cgeorgebell Twitter

Michael Ceci Michaelceci Twitter

Financials Statements And Resources Bissell Centre

How Far Does 100 Go In Your State Map Cost Of Living States

Renewable Energy Infographic Renewable Energy Solar Energy Facts Solar Energy Projects

Intuit Quickbooks Desktop Pro Plus 2021 With Payroll Enhanced 1 Year Subscription Windows Digital Quickbooks Payroll Accounting Software

Canadian Nonprofits Claim Government Targets Muslim Charities The Nonprofit Times